Year in Review

2023

Vision

Unleash the power of data to bridge the racial wealth gap.

Mission

To dismantle barriers to housing for working families.

Impact

Rent reporting impact

107,000+ renters established first-time credit scores with Esusu

We passed a momentous milestone this year, helping over 107,000 renters establish first-time credit scores. Many of these renters have gone on to access student loans, car loans, and 142 renters even accessed mortgages.

Credit scores are increasing nationwide

Renters are using their new and improved credit scores to better their lives

Esusu renters have now accessed over $21.7B in new credit tradelines

Esusu renters with new and improved credit scores are unlocking new credit opportunities, opening nearly half a million tradelines as of October 2023. These include credit cards, mortgages, and student and car loans. The latest data shows Esusu renters have now accessed:

33K+

Mortgages

42K+

42K+

Student loans

383K+

Credit cards

134K+

Auto loans

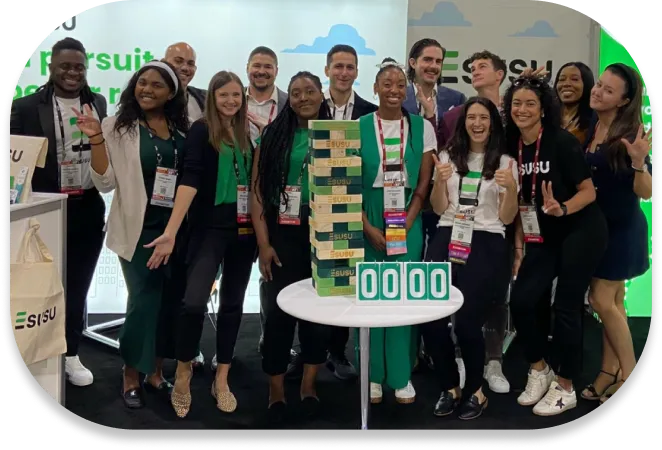

Company milestones

2023 marked our biggest year yet, including the launch of our new Resident Portal and recognition on the TIME100 Next and Forbes Fintech50 lists. We’re grateful to our team and partners who joined us on this journey.

Esusu Resident Portal and Marketplace

This fall, we introduced the Esusu Resident Portal, a hub for renter financial health. Esusu renters can now monitor their credit scores, track on-time payments, and access the Esusu Renters Marketplace. We’re excited to welcome partners like Sure Insurance, Grow Credit, Caribou, and many more to the Marketplace.

400,000+ renters reporting rent through Fannie Mae and Freddie Mac

We entered our second year of engagement with both Fannie Mae and Freddie Mac. The first year of the programs resulted in 2,000+ properties bringing free rent reporting to over 400,000 residents.

Distributing rent relief at scale with the Stable Home Fund

Our partnership with the Stable Home Fund has brought rent relief to thousands of residents, helping them avoid eviction and keeping cash flows positive for properties. Esusu and the Stable Home Fund helped over 8,000 families avoid eviction.

Celebrating an award-winning team

Esusu was recognized by some of the top awards, publications, and lists in the world, including:

- TIME100 Next

- LinkedIn Top Startups

- Forbes Fintech50

- Fortune Change the World list

- EY Entrepreneurs of the Year

Disclaimer: Reporting rent payments does not solely dictate credit score changes. Predicting the exact impact on your score is impossible, as individual credit profiles vary, influenced by various factors. All data in this report is accurate through October 2023.

Looking toward 2024: A letter from our founders

As we bid farewell to 2023, celebrating billions in unlocked capital and

assisting thousands of families in avoiding eviction, we reflect on a

year where renter financial wellness took the spotlight. None of this

would have been achievable without our industry's steadfast dedication

to financial inclusion. 2023 will be remembered, but 2024 is our next

destination—filled with shared success and prosperity. Our heartfelt

thanks for your support. Esusu’s best days are ahead.

Forward together,

Wemimo Abbey & Samir Goel